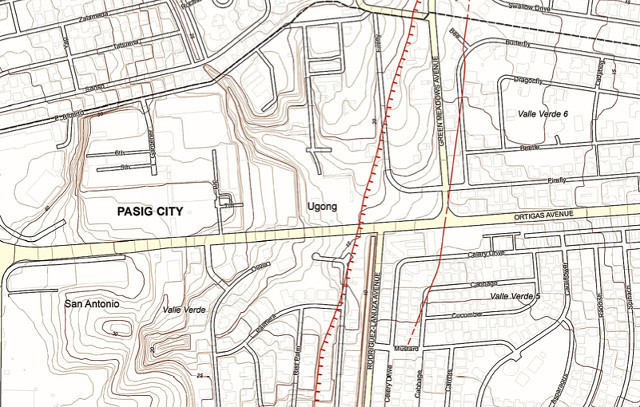

FAULT-RIDDEN. Active faults (red lines) cut through a part of Pasig City occupied by subdivisions Valle Verde 5 and 6. Image from Phivolcs' Valley Fault System Atlas

MANILA, Philippines – Maps recently released by the Philippine Institute of Volcanology and Seismology (Phivolcs) allow people to see the location of the West Valley Fault and East Valley Fault in Greater Metro Manila.

The question now is: do you live on an active fault?

Rappler compiled a list of subdivisions or residential villages that appear to have active faults.

At the end of this article, there is also a compilation of screengrabs from the Phivolcs maps showing where the faults are in those subdivisions.

The list only includes places where

houses appear to have been built on top of an active fault or where, based on the subdivision's structure, houses are likely to be built on top of the fault.

Affected subdivisions are diverse: from enclaves of the rich like Loyola Grand Villas in Quezon City, to the depressed Maharlika Village in Taguig.

Rappler found that 57 subdivisions or residential villages are transected by the West Valley Fault, a 100-kilometer active fault that can generate a 7.2-magnitude earthquake. (INFOGRAPHIC: How powerful is a magnitude 7.2 earthquake)

Only one subdivision, Gloria Vista Subdivision in Rizal province, is transected by the shorter East Valley Fault which can generate a 6.5-magnitude earthquake.

But we encourage you to take a look at the Valley Fault System Atlas yourself in case we missed something.

According to studies, residential buildings will suffer the most damage during a 7.2-magnitude earthquake because many of them do not follow building standards. Phivolcs Director Renato Solidum Jr said that at least 40% of all residential buildings in Metro Manila would either be heavily or partially damaged.

Subdivisions or villages with the West Valley Fault:

Rizal (Rodriguez)

Amity Ville

Christine Ville

Marikina

Loyola Garden Village

Loyola Subdivision

Monte Vista Village

Industrial Valley Subdivision

Cinco Hermanos Subdivision

Wood Crest Subdivision

Quezon City

Sunnyside Heights Subdivision

Doña Anna Village

Fil-Heights

Filinvest Homes II and Villa Amor Uno

Northview Subd

Loyola Grand Villas

White Plains Subdivision

Queensville Court

Greenmeadows

Blue Ridge B

Pasig

Valle Verde 6

Valle Verde 5

Valle Verde

Valle Verde 3

Valle Verde 1

Kawilihan Village

Makati

East Rembo

Pembo

Rizal

Taguig

Pinagsama

Pinagsama Phase II

Pan-Am Village

North Signal Village

Central Signal Village

South Signal Village

Maharlika Village

Camp Bagong Diwa

Parañaque

Posadas Village

Muntinlupa

Solid Mills Village

Embassy Village

Liberty Homes

Carmina Compounds

L&B Subdivision and Compound

UP Side Subdivision

Country Homes Alabang

Planas Ville

Camella Homes Alabang 3

Country Homes Subd and Jose Marey Subdivision

Camella Homes

Susana Heights Village 1

Susana Heights Subd Phase I

St Anne Homes

Real Ville Subdivision

Laguna

Adelina 1A Subdivision

GSIS Village

Elnor Homes

Sampaguita Village

United San Pedro Subdivision

Cavite

Wedgewoods Subdivision

Next steps

What do you do if your

house looks like it's near a fault?

Don't panic.

According to Phivolcs, you'll only need to consider moving out if your home is right on top of the fault or within 5 meters of it.

This is because your house may be at risk when the ground shifts beneath it during an earthquake.

Even if your home is outside the 5-meter bufferzone, it will still be subject to intense shaking during a 7.2-magnitude earthquake. You need to make sure it was built properly. (See groundshaking simulation map on this story: What dangers await when the West Valley Fault moves?)

You can consult a structural engineer to check if the building strictly follows the National Building Code of the Philippines.

Your local government also has building officials responsible for checking if structures in your city or province follow safety standards. But in many cases, these inspectors are handling too much

work to look into each building.

If your house is made from concrete hollow blocks, you can do the checking yourself using Phivolcs' checklist for earthquake-ready houses.

Looking to buy a house far from any active fault?

The Housing and Land Use Regulatory Board (HLURB) says they now require subdivision developers to get certification from Phivolcs to prove their project is far from a fault.

To be sure, you can ask the developers to show a copy of the certificate.

What do you do if your subdivision, city or province isn't in the list? Don't be complacent.

A 7.2-magnitude earthquake will be so strong it will likely be felt even in cities without the West Valley Fault.

The Manila Cathedral in Manila, for instance, has been damaged many times by earthquakes generated by the fault.

Have your homes checked for safe building standards, don't take earthquake drills for granted, and always be ready for any scenario.

Source: Excerpts from Rappler.com